Running is an enticing and addictive activity, but there are a few things to keep in mind to avoid injuries. (more…)

A Final Expense policy is the best way to protect your loved ones in one of the most critical moments in life: our death. (more…)

Funerals are a challenging topic, and when money is added to the mixture, it gets even more difficult to discuss. But even though discussing funeral arrangements is emotionally challenging, it is important to do, especially after a certain age. Having open conversations about one’s last wishes is quite necessary, mainly for the family, who’s often left without directions on what to do. Considering that nowadays almost any aspect of a funeral can be planned ahead (venue, service elements, mementos or burial plot, and so on), it is a great way to spare loved ones from making stressful decisions - that might also impact them financially.

For most American families, organizing a funeral can represent a great struggle. After all, how can a family on low-income find $8,000 in a short space of time to cover funeral costs?

According to US Funerals, now more than ever, “funeral homes find themselves in the position of having to negotiate payment terms with a family who has requested the funeral home’s services before realizing the implications of the cost.”

It is clear Americans struggle with final expenses. And for that reason, it is even more evident that getting informed and planning with time is key to spare loved ones from suffering the financial repercussions.

Everyone knows funerals aren't exactly cheap. In fact, according to recent statistics, funeral costs in the United States have risen faster than virtually everything else over the last 30 years. From December 1986 to September 2017, funeral expenses rose 227.1 percent, which is leading many American families to debt. But why is that?

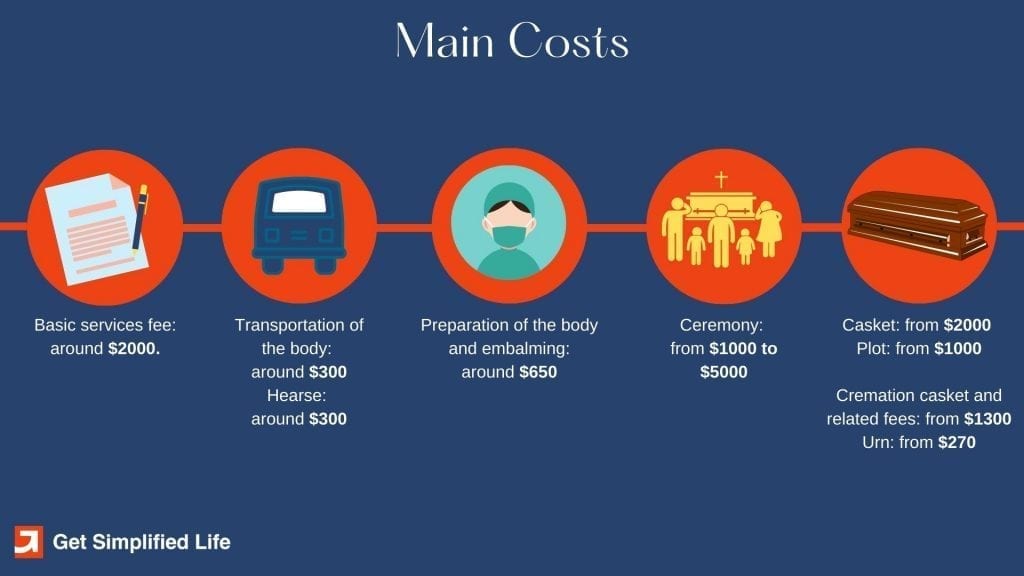

First of all, funerals require many services, including the body's transportation to the funeral home, the notary services, cleaning and dressing the body, embalming, burial or cremation, and funeral ceremonies. Considering all the steps and professionals involved, it is understandable that prices rise so much.

Here are some of the most general costs related to the ceremony:

But that's not all. Many families tend to overspend on funerals due to the emotional impact of losing a loved one. It is tough to make rational decisions in a moment of grief, which explains why so many families stick with the first option they find, without making an effort to compare providers and packages.

Besides, the lack of time and experience in this sector is also a problem for finding the best prices and alternatives. Considering that, most times, families have only two to three days to plan the whole ceremony, it is understandable why decisions are made in a rushed and uneasy mood.

In the end, summing up all these factors, funerals end up costing way more than expected. From choosing the flowers to deciding on a plot, every item comes with a cost that can drastically influence the final price.

The cost of a funeral or cremation is different in every state. For example, a funeral and burial in Alabama costs far less than the same services in New York. Nonetheless, according to the National Funeral Directors Association, the average cost of a funeral with viewing and burial is around $7,360. For a burial with a cement vault (as required by most cemeteries), the cost increases to $8,700.

Finally, for those interested in cremation, the costs can be considerably lower. According to the Cremation Institute, the average national cost of cremation in the US is around $3000-$4000. In some states, however, it can reach up to $10,000.

As we’ve seen above, they can be quite different. Here’s a quick breakthrough of the average funeral prices in each state:

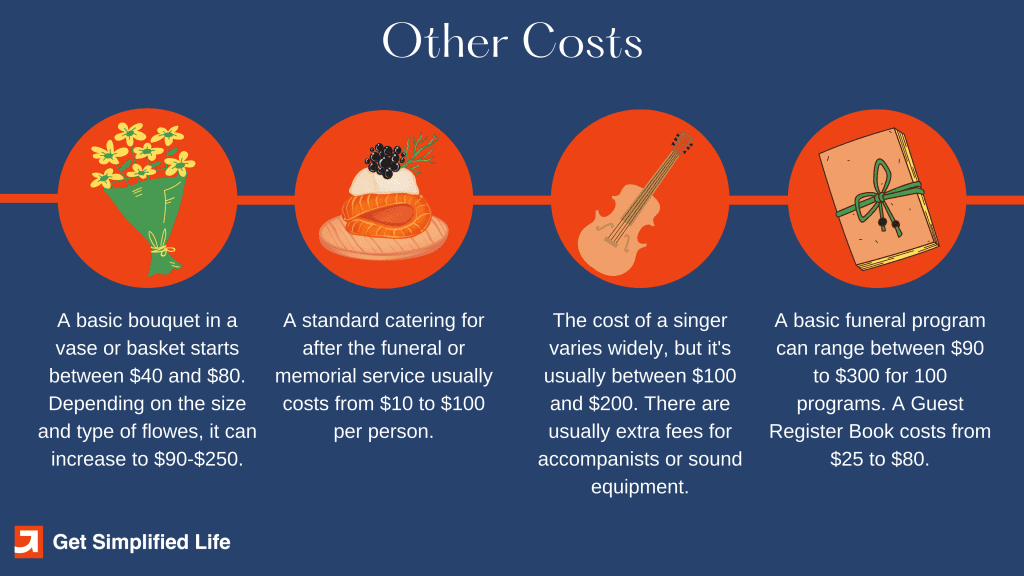

The cost of a funeral can vary dramatically, depending on what the family wants and can afford. But what usually happens is that, regardless of all the planning, the whole ceremony ends up costing way more than expected. This happens because, apart from the essential services, many extra costs are usually forgotten - and those costs can add up dramatically to the final funeral’s final price. Here are some of them:

Yes it is! Funerals typically take place within a limited and emotionally tough time frame, which leads many families to stick with the first provider and package they find. But the truth is that, with some research and time, it is possible to cut on several costs. For example, comparing prices online and requesting several no-obligation quotes is a great first step to find better deals. Having at least three quotes, with an itemized price breakdown, should be a top priority before making a decision.

Another good tip is to save on the casket. Most funeral houses will recommend expensive caskets, because they are more resistant and protective. However, it is important to keep in mind that an elaborate casket, made of copper or bronze, can cost as much as $10,000. For those that want to save as much money as possible, there are many alternatives to consider when it comes to the casket. For instance, both Walmart and Costco offer a cheaper range of caskets, with prices ranging from $899.99 to nearly $4,000.

Finally, it is also possible to skip the balming (which usually costs around $500-$700), and ask the funeral house if refrigeration is an option - which usually is the case. The same goes for the extra costs mentioned above; the catering, musicians, flower arrangements and other details aren’t mandatory. Dispensing most of them, or giving preference to low cost and DIY solutions can help save a few hundred dollars.

Are you starting to worry about your final expenses? Do you fear that your life savings won’t be enough to cover for them and that your family might have to step up? Would you like to spare them from such responsibility and even present them with an unexpected legacy? There’s only one logical solution to these worries: a Final Expense plan.

Final Expense is a type of Life insurance that helps your loved ones with taking care of your final expenses (such as a funeral, cremation, casket, etc.), as well as covering outstanding medical bills or debts that you might leave. It can also serve to leave a legacy or safety net to your family. Suppose that you have small grandchildren who would like to go to college and pursue a promising career. With a Final Expense plan, you can present them with that opportunity - and many others.

In short, it is a plan meant to protect your family’s financial stability and provide them the opportunities you’ve always wished for them.

At Get Simplified Life, we offer you the possibility of acquiring the perfect Final Expense for your needs through a simplified application process. By simplified we mean no paperwork, no face-to-face meetings, and no medical exams. With our plan, your loved ones can get up to $35,000 in permanent coverage to pay for your final expenses and avoid funeral-related debt. Depending on the benefit amount, they may even receive a legacy that they can use to pay a mortgage, tuition, or however they find suited.

Would you like to know more about our Final Expense policy and even receive a quote? If so, please get in touch with us through our contact page or complete our short quote form for a no-obligation free quote.